Tognoli Insights

How Do You Defer Capital Gains Tax? Opportunity Zones are the New go-to for Investors

Opportunity Zones are becoming more well known across the country. They are a legal way to “wash” your gain on stock, bonds, real estate..and they defer capital gains tax! You name it and if you have a gain, you can use the Opportunity Zone option as a possible strategy to eliminate having to pay that big fat tax bill.

For example, let's say you bought Apple stock for a total of $200,000 and later sold it for $300,000. Normally you would report a $100,000 capital gain on your tax return. Now, with the new Opportunity Zone option, you can choose to reinvest the $100,000 gain in an Opportunity Zone or business within 180 days and defer the gain.

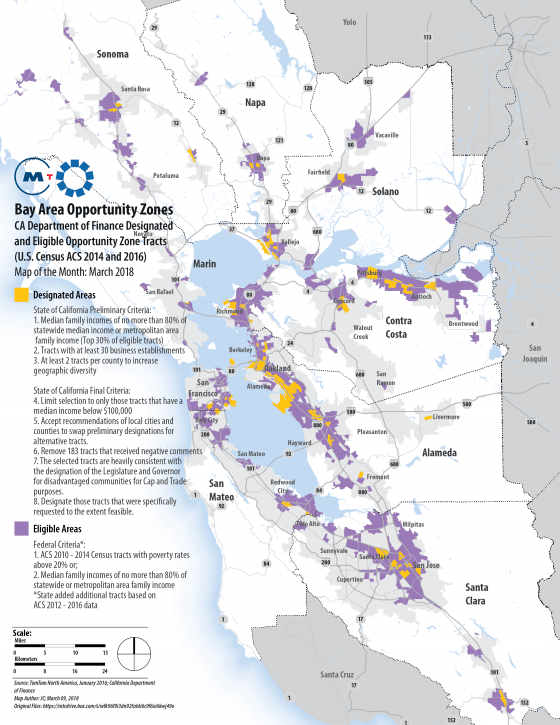

Opportunity Zones are a new section of the tax code that was added by the Tax Cuts and Jobs Act on December 22, 2017. They are areas that have been identified as economically distressed communities where new investments may be eligible for preferential tax treatment. The purpose of the zones is to spur economic development and job creation in distressed communities. Investments in Qualified Opportunity Zones allow for a gain deferral and potentially a partial exclusion of capital gains income.

So, if you have gains from the sale of anything that is deemed capital in the IRS tax code, whether long or short term, you are now able to defer the recognition for tax purposes.

The deferral would further work as follows:

- Sell stock and recognize gain. Make the election on your tax return that states you wish to defer the gain, on Form 8949.

- Invest gain into a Qualified Opportunity Zone or Business within 180 days.

- If you hold the investment for 5 years from the date of contribution, you can exclude 10% of the gain. (You have until 12/31/2021 to be able to exclude the additional 10%)

- If you hold the investment for 7 years from the date of contribution, you can exclude an additional 5%. (You have until 12/31/2019 to be able to exclude the additional 5%)

- Pay the taxes on the gain when you sell the position or December 31, 2026, whichever comes sooner.

- Hold the position for 10 years or longer and get a step up in basis to the investments Fair Market Value

- Sell the fund/Opportunity Zone investment no later than 12/31/2047

You can invest in Opportunity Zones through funds, or you can purchase property in designated opportunity zones like my team does. Of course, that is just the tip of the iceberg and there is a lot more to know when it comes to investing in Opportunity Zones. If you are interested in learning more, talk with your financial advisor and/or CPA. You can also feel free to ping me and I will connect you with Shanna Tomko on our team who did all of our research. Shanna is our CPA and also an investor.